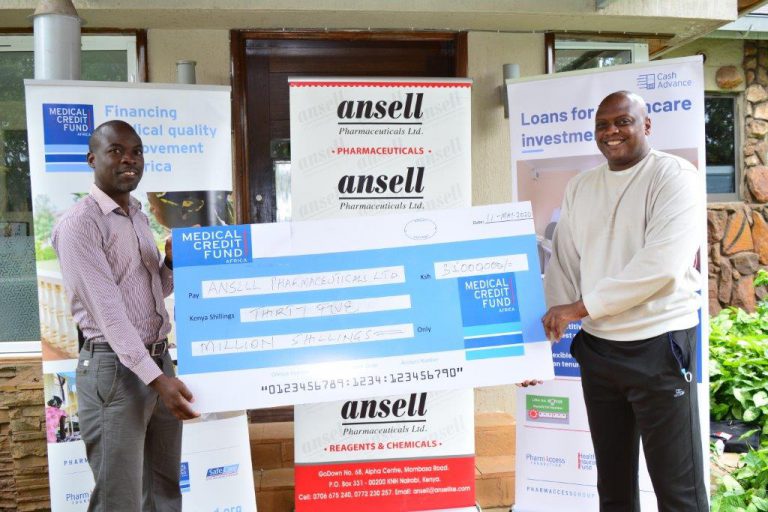

Dr. David Karanja, owner of Ansell Pharmaceuticals, receives the first Covid-19 specific loan. ”A timely intervention”, he says.

The COVID-19 specific loans are earmarked for manufacturing, importation and/ or distribution of Covid-19 related commodities such as face masks, eye protection, gloves, gowns and hand sanitizers.

The Medical Credit Fund–part of the PharmAccess Group –finances small and medium-sized healthcare facilities in Africa in a bid to improve access to quality services for low-income patients.

This is because the healthcare companies (health SMEs) have poor infrastructure, equipment and limited means to invest in quality improvement. However, commercial banks shy away from these health SMEs because they consider them to be too risky.

Dr. David Karanja, a pharmacist and owner of Ansell Pharmaceuticals says they are committed to providing quality and reasonably priced pharmaceutical and surgical products. “The loan from MCF is a timely intervention as it enables us to be in the frontline to supply the much needed medical equipment and related supplies to combat the pandemic,” he says.

The World Health Organization (WHO) estimates that globally, 89 million medical masks are required for the COVID-19 response each month. For examination gloves, that figure goes up to 76 million, while international demand for goggles stands at 1.6 million per month, and called on industry and governments to increase manufacturing by 40 per cent to meet rising global demand.

Kennedy Okong’o, Director MCF Kenya says: “The COVID-19 pandemic has thrust the health enterprise into unprecedented times. Many health entrepreneurs have faced both health and economic impacts occasioned by low patient traffic and an interrupted supply chain. Our core business is to keep the health business running. That is why we have responded by developing Covid-19 specific loans and restructured existing loans to cushion our clients”.

MCF uses innovative financing solutions and digital technologies to cater to the financing needs of health SMEs such as invoice discounting and digital loans.

Dr Karanja says that he turned to MCF after his banks turned down his loan application. “My own bank turned me down and that is when I contacted MCF. The application process is easy. I furnished them with supply invoices and in three days the money was in my account,” he adds.

Some of the MCF clients include hospitals, clinics, diagnostic centres, pharmacies and training institutes. MCF also provides healthcare providers with technical assistance to help improve their quality and increase their capacity.

To date, Covid-19 specific loans worth KES 148m have been issued to manufacturers and suppliers of pharmaceutical supplies in Kenya and Uganda.